Case Study #1: The IRS seized this guy's life savings. Now he's getting it back.

- Feb 26, 2016

- 4 min read

In June 2014, the IRS seized $153,907.99 from Ken Quran's bank account -- his life savings -- even though he did nothing wrong.

Now, after months of struggle, it looks like the North Carolina convenience store owner is finally going to get it back.

"We asked the IRS to do the right thing, and it did," said Robert Everett Johnson, an attorney for the Institute for Justice, which took Quran's case pro bono.

The IRS wouldn't confirm or deny whether the case was resolved, citing federal privacy laws. Johnson submitted a petition to the IRS asking that Quran's life savings be returned. After hearing nothing for six months, Johnson sent a letter this week to IRS Commissioner John Koskinen, inquiring about the status of the petition.

"Ken is unsure how he will ever be able to afford to retire, as the IRS seized the entire bank account for his business," Johnson wrote.

And the agency did so without ever accusing Quran of any crime.

Here's how: Under federal bank "structuring" laws, the IRS may seize a person's bank assets if it discovers a pattern of frequent transactions under $10,000. Banks are required to report cash transactions over $10,000 and it's a crime if one tries to avoid that reporting by purposefully keeping all transactions below that amount.

The laws are intended to suss out drug trafficking, money laundering and organized crime or terrorist activity. But the IRS doesn't need any evidence of wrongdoing before seizing the money. The end result: Anyone who runs a cash business, such as a convenience store, a restaurant or a bar, can get snared even though they've done nothing wrong.

And people like Quran, 61, don't know what hit them. His bank agreed to give him a $50,000 line of credit to keep his business running.

"I'm working every day, seven days a week. They don't have a right to treat me like that," he told CNNMoney.

The good news is that the IRS changed its policy in October 2014. It decided it would no longer pursue cases with a pattern of transactions under $10,000, if there is no basis to think illegal activity is involved.

The change of policy, however, is not legally binding, Johnson said. And it didn't help resolve Quran's case or other prior cases involving more than 600 people who had at least $43 million seized since 2007.

The Institute for Justice hopes that the resolution of Quran's case will help others, like Maryland dairy farmer Randy Sowers. Sowers, whom IJ also represents, had $60,000 seized and the IRS has only returned half of it. He's petitioned to get back the other half.

"If the IRS is willing to do the right thing for Ken, they should do the right thing for Randy -- and all the other property owners in the same situation," Johnson said in a statement. "Today's decision opens a way for other victims of the structuring laws to get back what's rightfully theirs."

CNNMoney (New York) First published February 19, 2016: 6:06 PM ET

How could the STS Program have protected this man from the IRS's unwarranted attack?

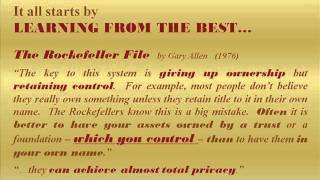

The lesson should be obvious from reading this case. If you OWN something in your own NAME, it can be taken from you. Even when you are in the right, a rogue creditor can confiscate your assets and cause great hardship and legal fees as you fight to get your assets back.

For any business owner who runs a largely cash business, you need to protect yourself. Had Quran been introduced to the STS program, he could have insulated the majority of his cash from legal attack using the Trust strategy and this suggested structure:

Step 1: Create the STS basic program with the basic Trust 1 - LLC - Trust 2 - UCC Lien structure.

Step 2: Trust 1 creates a second LLC (ManageCo) as a management company to oversee the current retail business operation.

Step 3: The shares of the active retail business can either be left in the name of the current owners, or transferred to Trust 1 making it the member. A transfer helps maintan privacy of ownership by severing the link to the business founder.

Step 4: As RetailCo collects cash from daily sales (4a), it pays operating expenses and supplies from cash proceeds (4b) and then deposits the rest in its bank account. It then issues a net income cheque to ManageCo to pay for management services (4c), thereby leaving just enough cash n the RetailCo bank to cover short-term cash needs. This is all that will be left open to seizure.

Step 5: ManageCo pays its own operating expenses from its management fees, and then transfers the remaining funds to Trust 1 (which is the 100% shareholder of ManageCo.) This cash equity transfer should occur regularly, at least on a monthly basis.

The end result of all of this, is that the bank account of the RetailCo will hold very little proceeds at any one time, thereby reducing the likelyhood of a sizeable confiscation. Cheques paid to the ManageCo are legitimate expenses and not likely seizable without a court judgement. The further transfer from ManageCo to Trust 1 adds one more level of separation from the RetailCo operation. This strategy should effectively insulate the business's cash from the type of asset siezure seen in this case study.

The #1 lesson in asset protection is Own Nothing; Control Everything. The #2 lesson is separation, separation, separation.

To learn more about this strategy and its appropriateness to you, please Contact Us today to request a due dilignce package.

Comments